Your cart is currently empty!

Tag: business

-

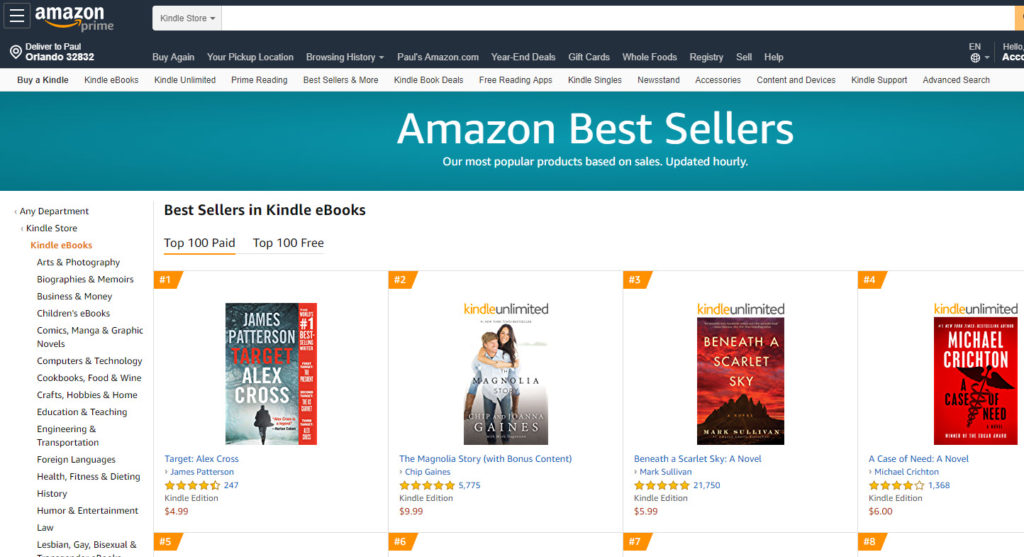

Business of Writing: We’re #1!!

Well, no, not really. As of this writing, James Patterson is #1, but it would be nice, right? Number one seller in the Amazon US store?

Maybe.

It would certainly mean a lot of sales, and a lot of visibility, but, for most authors, it would come at a cost in advertising dollars. Dollars that might be better spent in maintaining a longer placement somewhere else in the Amazon ranks. Number one on Amazon, even number one in many categories and subcategories, might not be the optimal goal.

Okay, an aside: Yes, it’s a satisfying thing, and I have a collection of screenshotted orange badges for #1 in categories — Steampunk, Space Opera, Space Fleet — as well as some screen shots of the times I’ve hit the top 100 SciFi authors list on Amazon, if only for a brief, fleeting moment. I pull those out from time to time and it makes me feel good. Sometimes, I print them out on little bits of paper, fill the bathtub with them, and …

Never mind.

This series of posts is about business, and business means money. Money comes from sales, not prestige, though there’s a certain correlation between the two.

So, what rank should you be trying for in your advertising? Well, first, why are you advertising at all? What’s your purpose?

If you have one book, or even, maybe, a number of stand-alones, then you might be after sales, and this post probably isn’t for you. This post is for the authors, like me, who have a series.

When we advertise, it’s usually with a free or discounted book. That’s the hook, right? Check out this book and you can do so on the cheap. We’re hoping that a reader, entering on the cheap, will read through the rest of our books at the full price.

My own advertising is generally of Into the Dark, which is currently $0.00. So conventional calculations of ROI are pretty pointless — there’s 0 ROI on someone picking up Into the Dark. Read through is where the money is — and there’s a calculation to figure it out.

(book2royalty x book2readthrough) + (book3royalty x book3readthrough) + ad catalogum

The expected dollar value of a new reader comes from that.

But there’s another value that comes from the ad responses, which is our books’ rank. We know that rank equals visibility, and visibility equals sales. But how high a rank is good enough?

My books are not mainstream. They’re quite niche. A little bit of Steampunk feel, in the late-18th century naval environment. A little bit of Space Fleet, for those willing to put up with the late-18th century naval environment. A dash of Space Opera, in that they’re so character focused.

If I were to hit #1 in the whole store with an ad blitz and knock James Patterson

‘s ghost writerout of that spot, would it really do me any good so far as visibility goes?I don’t think so. I think above a certain rank is wasted for me. The folks looking at the Amazon Top 100 or even the Science Fiction Top 100 are probably not my market. They aren’t folks who’ll like my books, or, if they are, there aren’t enough of them looking there to make it worth the effort and expense.

I want to keep Into the Dark in the top twenty or so free books of my main categories: Steampunk, Space Opera, Space Fleet, and, on a good day, Military as a whole — and I want to stay there as long as possible, not flash up to #1 in SciFi and then be back in the doldrums a week or two later.

I want the eyeballs of someone who’s looking in those categories, specifically, today, tomorrow, next week, a month from now, and six months from now. So I keep my ads and the spend on them tailored to do just that.

If it was all about big visibility instead of targeted visibility, after all, then we’d all be advised to take out

SuperbowlBig Game (edited on advice of trademark counsel) ads for our books. -

Business of Writing: Qualified Business Income Deduction

I slacked off a bit in this series this year, but this tax change is too important and too easy to miss for me not to give a brief post about it.

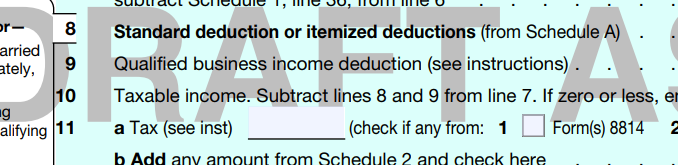

As part of the tax changes in 2018, there is a what’s called the Qualified Business Income Deduction. This isn’t on the Schedule C and it’s a single line on the 1040, so it’s going to be easy to overlook (and expensive if you do).

In the draft 1040, it’s line #9 there, right under the Standard or Itemized Deduction line. Still in draft form as of this writing, the 1040 instructions are here: https://www.irs.gov/pub/irs-dft/i1040gi–dft.pdf

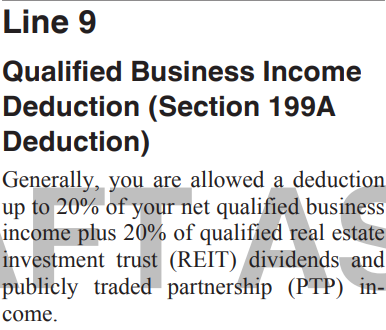

This deduction is explained on page 34 of the instructions (don’t get me started on 119 pages of instructions for this stupid … never mind. Tax protest is for another post).

For most authors, this is going to be a deduction of 20% of your net business income from Schedule C after expenses.

If you incorporated as a C-corp (unlikely) you’re out of luck, but for sole proprietors, LLCs, and S-corps, this applies, though there are some kinks around S-corps that you’ll want to talk to your tax professional about.

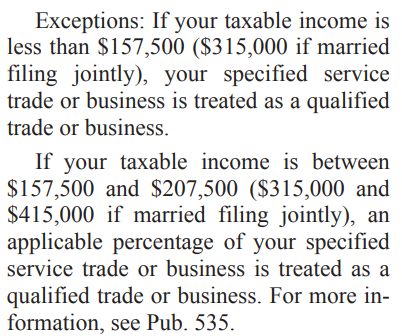

There are also some income limits. $157,500 if single or $315,000 if married. If your income is below those thresholds, then you’re good — if above that (congratulations!) there are some additional calculations to do and the deduction starts to phase out (boo!).

So, familiarize yourself with this deduction and make sure your tax professional (if you use one) is familiar as well. This is new, so a lot of them might not think of it.

“But wait!” you or your tax professional say. “Certain trades or business are not eligible for this deduction, based on whether the business relies on the personal services yadda-yadda-yadda. And I’m a writer, so it’s my personal yadda-yadda that yadda-yaddas.”

No.

Your business is publishing and selling books. That’s where your money comes from. That you wrote the books isn’t really relevant, because you receive no money for the writing, only for the selling. Your business is publishing — if you died tomorrow, the business could go on publishing, selling, and making money without your personal writing talents. The business could publish someone else’s writing just as easily.

If you get a significant amount for personal appearances, teaching classes, etc. then you might fall into this category, but the typical author won’t bet here.

Even if you are in that small group, the business is qualified if income is below the $157k/$315k threshold.

So enjoy this extra 20% deduction while it lasts, since you never know when some bloody bastard’s going to come along and remove it.